VANCOUVER, CANADA – Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) today announced consolidated financial results for the third quarter ended September 30, 2024. All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (IFRS).

“We had a tough quarter, marked by weak revenue, strained gross margin, soft new order intake, adverse order book adjustments, a restructuring charge of $16.1 million, and non-cash impairments totaling approximately $147.0 million,” stated Randy MacEwen, Ballard’s President & CEO. “We have taken difficult but important actions to better align our spending with a multi-year push-out in market adoption of hydrogen and PEM fuel cells.”

Mr. MacEwen continued, “In Q3, we initiated a global corporate restructuring to reduce total annualized operating costs by more than 30%. We expect a substantial part of the annualized cost savings to be realized in 2025. Our restructuring includes a sizeable workforce reduction, rationalization of product development programs, consolidation of global operations and facilities, and a reduction in planned capital expenditures. As part of our global restructuring, we also reduced our corporate cost structure in China and initiated a strategic review of our China joint venture.”

Mr. MacEwen further commented, “We have successfully repositioned our Texas gigafactory expansion program to an optionality plan, where we will defer our final investment decision to 2026 pending clear market adoption and demand indicators, while still preserving over $94 million of awarded government funding. With no material capital investments planned during this optionality period, we will reassess the underlying business case in 2026.”

“With the backdrop of a challenging industry context, we had soft revenue and new order intake performance in Q3. We also

removed previously booked orders valued at $39.2 million from our Order Backlog relating to certain high-risk markets and customers, including in China. Notwithstanding these challenges, Bus continues to be a notable bright spot, with Q3 revenue up 33% year-over-year. We remain encouraged with our continued customer progress in the Bus, Rail and Stationary markets in Europe and North America. Indeed, given current customer engagement in these markets, we expect a pick-up in new order intake in Q4, including from our recently announced supply agreement with New Flyer for 20 MW of fuel cell engines for the North American bus market.”

“As we look to our long-term strategic plan and cascading capital allocation, we continue to have high conviction on hydrogen and PEM fuel cells playing an important role in decarbonizing select heavy mobility and stationary power applications. We see compelling use cases where customers are attracted to the differentiated PEM fuel cell value proposition of long range, fast refueling, heavy payload, and zero emissions. Our focus is on our customers and our controllables, including the development of next-generation, low-cost fuel cell products, while maintaining disciplined spending and balance sheet strength for long-term competitiveness and sustainability,” concluded Mr. MacEwen.

Q3 2024 Financial Highlights

(all comparisons are to Q3 2023 unless otherwise noted)

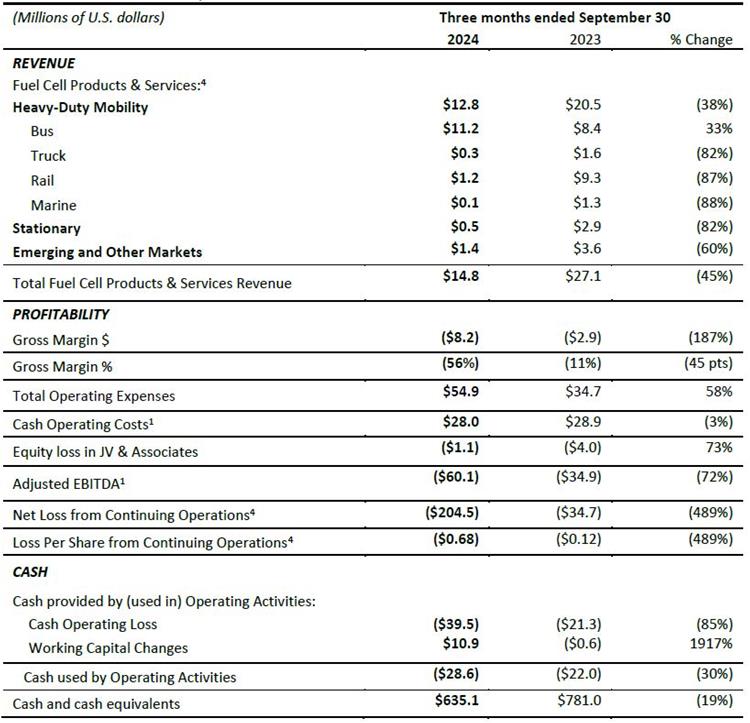

- Total revenue of $14.8 million in the quarter was down 45% year-over-year due to slowing customer demand, reflective of a push-out in the adoption curve for hydrogen and PEM fuel cells.

- Heavy Duty Mobility revenue of $12.8 million was down 38%, driven by lower revenues from Rail, Truck, and Marine verticals and partially offset by Bus revenues of $11.2 million, which were up 33% year-over-year.

- Stationary revenue of $0.5 million decreased 82%.

- Emerging and Other Markets revenue of $1.4 million was down 60%

- Gross margin was (56%) in the quarter 45 points lower year-over-year as a result of lower revenue, revenue mix, and onerous contracts and inventory provisions.

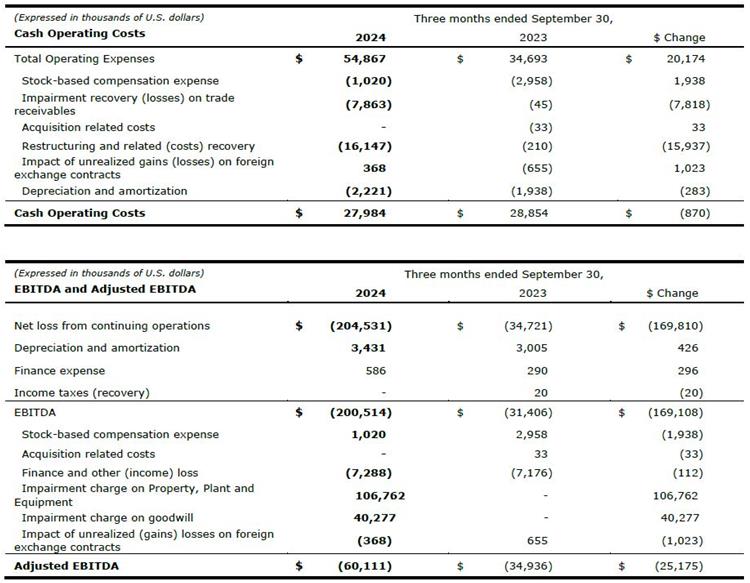

- Total Operating Expenses were $54.9 million in the quarter, an increase of $20.2 million or 58% year-over-year, primarily driven by a restructuring charge of $16.1 million and a $7.9 million impairment of certain trade receivables. Cash Operating Costs1 were $28.0 million, a decrease of (3%).

- Net loss from continuing operations was ($204.5) million, or ($0.68) per share, which includes $40.3 million of non-cash impairment charges on goodwill and $106.8 million of property, plant, and equipment impairment. Excluding goodwill and other impairments, a Net Loss of ($57.5) million, or ($0.19) per share was recorded in the quarter compared to ($34.7) million, or ($0.12) per share, in the prior year period.

- Adjusted EBITDA1 was approximately ($60.1) million, compared to ($34.9) million, a change of (72%), largely driven by lower revenue, weaker gross margin, and a $16.1 million restructuring charge.

- Cash and cash equivalents were $635.1 million, a ($42.9) million decrease compared to $678.0 million at the end of Q2 2024.

- Ballard received approximately $7.1 million in new order intake during Q3, while removing previously booked orders valued at $39.2 million from our Order Backlog relating to certain high-risk markets and customers, including in China, resulting in net new orders of ($32.1) million in the quarter. Ballard delivered orders valued at $14.8 million, resulting in an Order Backlog of approximately $122.7 million at end-Q3, a 28% decrease from the end of Q2 2024.

- The 12-month Order Book, which was also impacted by delivery of orders in Q3, low new order intake, and the removal of previously booked orders, was $58.2 million at end-Q3, a decrease of $17.3 million, or (23%), from the end of Q2 2024.

| Order Backlog ($M) | Order Backlog at End-Q2 2024 | Orders Received in Q3 2024 | Orders Removed in Q3 2024 | Orders Delivered in Q3 2024 | Order Backlog at End-Q3 2024 |

| Total Fuel Cell Products & Services | $169.5 | $7.1 | $39.2 | $14.8 | $122.7 |

2024 Outlook

Consistent with the Company’s past practice, and in view of the early stage of hydrogen fuel cell market development, specific revenue or net income (loss) guidance for 2024 is not provided. Similar to previous years, the Company expects 2024 revenue to be weighted to Q4. Total Operating Expense2, excluding restructuring charges, and Capital Expenditure3 are expected to be at the low end of their respective guidance ranges. With restructuring charges included, Total Operating Expense2 is expected to be at the high end of the guidance range. Total Operating Expense2 and Capital Expenditure3 guidance ranges for 2024 are as follows:

| 2024 | Guidance |

| Total Operating Expense2 | $145 – $165 million |

| Capital Expenditure3 | $25 – $40 million |

Q3 2024 Financial Summary

For a more detailed discussion of Ballard Power Systems’ third quarter 2024 results, please see the company’s financial statements and management’s discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Conference Call

Ballard will hold a conference call on Monday, November 5, 2024 at 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time) to review second quarter 2024 operating results. The live call can be accessed by dialing 1-844-763-8274. Alternatively, a live audio and webcast can be accessed through a link on Ballard’s homepage (www.ballard.com). Following the call, the audio webcast and presentation materials will be archived in the ‘Earnings, Interviews & Presentations’ area of the ‘Investors’ section of Ballard’s website (www.ballard.com/investors).

About Ballard Power Systems

Ballard Power Systems’ (NASDAQ: BLDP; TSX: BLDP) vision is to deliver fuel cell power for a sustainable planet. Ballard zero-emission PEM fuel cells are enabling electrification of mobility, including buses, commercial trucks, trains, marine vessels, and stationary power. To learn more about Ballard, please visit www.ballard.com.

Important Cautions Regarding Forward-Looking Statements

Some of the statements contained in this release are forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws, such as statements concerning the markets for our products, Order Backlog, expected revenues, gross margins, operating expenses, capital expenditures, corporate development activities, impacts of investments in manufacturing and R&D capabilities and cost reduction initiatives. These forward-looking statements reflect Ballard’s current expectations as contemplated under section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Since forward-looking statements are not statements of historical fact and address future events, conditions and expectations, forward-looking statements by their nature inherently involve unknown risks, uncertainties, assumptions and other factors well beyond Ballard’s ability to control or predict. Actual events, results and developments may differ materially from those contemplated by such forward-looking statements. Any such statements are based on Ballard’s assumptions relating to its financial forecasts and expectations regarding its product development efforts, manufacturing capacity, market demand and financing needs. For a detailed discussion of the factors and assumptions that these statements are based upon, and factors that could cause our actual results or outcomes to differ materially, please refer to Ballard’s most recent management discussion & analysis. Other risks and uncertainties that may cause Ballard’s actual results to be materially different include general economic and regulatory changes, detrimental reliance on third parties, successfully achieving our business plans, achieving and sustaining profitability, Ballard’s condition requiring anticipated use of proceeds to change and the timing of, and ability to obtain, required regulatory approvals. For a detailed discussion of these and other risk factors that could affect Ballard’s future performance, please refer to Ballard’s most recent Annual Information Form. These forward-looking statements represent Ballard’s views as of the date of this release. There can be no assurance that forward-looking statements will prove to be accurate, as actual events and future events could differ materially from those anticipated in such statements. These forward-looking statements are provided to enable external stakeholders to understand Ballard’s expectations as at the date of this release and may not be appropriate for other purposes. Readers should not place undue reliance on these statements and Ballard assumes no obligation to update or release any revisions to them, other than as required under applicable legislation.

Further Information

Sumit Kundu – +1.604.453.3517, investors@ballard.com or media@ballard.com

Endnotes

1 Note that Cash Operating Costs, EBITDA, and Adjusted EBITDA are non-GAAP measures. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Ballard believes that Cash Operating Costs, EBITDA, and Adjusted EBITDA assist investors in assessing Ballard’s operating performance. These measures should be used in addition to, and not as a substitute for, net income (loss), cash flows and other measures of financial performance and liquidity reported in accordance with GAAP. For a reconciliation of Cash Operating Costs, EBITDA, and Adjusted EBITDA to the Consolidated Financial Statements, please refer to the tables below.

Cash Operating Costs measures total operating expenses excluding stock-based compensation expense, depreciation and amortization, impairment losses or recoveries on trade receivables, restructuring charges, acquisition related costs, the impact of unrealized gains or losses on foreign exchange contracts, and financing charges. EBITDA measures net loss excluding finance expense, income taxes, depreciation of property, plant and equipment, and amortization of intangible assets. Adjusted EBITDA adjusts EBITDA for stock-based compensation expense, transactional gains and losses, acquisition related costs, finance and other income, recovery on settlement of contingent consideration, asset impairment charges, and the impact of unrealized gains or losses on foreign exchange contracts.

2 Total Operating Expenses refer to the measure reported in accordance with IFRS.

3 Capital Expenditure is defined as Additions to property, plant and equipment and Investment in other intangible assets as disclosed in the Consolidated Statements of Cash Flows

4 We report our results in the single operating segment of Fuel Cell Products and Services. Our Fuel Cell Products and Services segment consists of the sale of PEM fuel cell products and services for a variety of applications including Heavy-Duty Mobility (consisting of bus, truck, rail, and marine applications), Stationary Power, and Emerging and Other Markets (consisting of material handling, off-road, and other applications). Revenues from the delivery of Services, including technology solutions, after sales services and training, are included in each of the respective markets.

During the fourth quarter of 2023, we completed a restructuring of operations at Ballard Motive Solutions in the U.K. and effectively closed the operation. As such, the historic operating results (including revenue and operating expenses) of the Ballard Motive Solutions business have been removed from continuing operating results and are instead presented separately in the statement of comprehensive income (loss) as loss from discontinued operations.